As anticipated, the Bank of Japan (BoJ) has formalized her assimilation of the policies embraced by her contemporaries, the US Federal Reserve and the ECB

The Bloomberg reports,

The Bank of Japan (8301) set a 2 percent inflation target and said it will shift to Federal Reserve-style open-ended asset purchases in its strongest commitment yet to ending two decades of deflation.The central bank will buy about 13 trillion yen ($145 billion) in assets per month from January 2014, including about 2 trillion in Japanese government bonds and about 10 trillion yen in treasury bills. The BOJ previously said it would ease until 1 percent inflation is “in sight.”

Like all inflationism, the initial impact has been to trigger an artificial boom whose price will paid overtime via an eventual bust (most likely triggered by the return of bond vigilantes) or from a currency crisis.

Nonetheless Mark Twain once said that history does not repeat itself but it may rhyme. Telegraph’s Ambrose Evans Pritchard suggests that Abenomics could be a replay of "Japan’s Keynes" Korekiyo Takahasi:

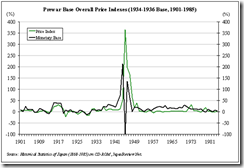

Premier Shinzo Abe has vowed an all-out assault on deflation, going for broke on multiple fronts with fiscal, monetary, and exchange stimulus.This is a near copy of the remarkable experiment in the early 1930s under Korekiyo Takahasi, described by Ben Bernanke as the man who "brilliantly rescued" his country from the Great Depression.Takahasi was the first of his era to tear up rule book completely. He took Japan off gold in December 1931. He ran "Keynesian" budget deficits deliberately, launching a New Deal blitz before Franklin Roosevelt took office.He compelled the Bank of Japan to monetise debt until the economy was back on its feet. The bonds were later sold to banks to drain liquidity.He devalued the yen by 60pc against the dollar, and 40pc on a trade-weighted basis. Japan's textile, machinery, and chemical exports swept Asia, ultimately causing the British Empire and India to retaliate with Imperial Preference and all that was to follow -- and there lies the rub, you might say.Takahasi was assassinated by army officers in 1936 when he tried to tighten by cutting military costs. Policy degenerated. Japan later lurched into hyperinflation.

Then Takahasi’s adaption of inflationism signified as mostly resource transfers to the military, the latter of which became the dominant force in her domestic policy affairs, which as noted above, was epitomized by Takahasi’s assassination.

And instead of reducing deficit spending, the Wikipedia.org notes that, the military influenced government "introduced price controls and rationing schemes that reduced, but did not eliminate inflation, which would remain a problem until the end of World War II".

And like Germany, the Takashi inspired inflationism resulted to the massive build up of Japan's military might, which thus critically contributed to materialization of World War II.

Yet Japan eventually succumbed to a post war hyperinflation (JapanReview.net).

Things are different today than in the 1930-1945. Japan has the largest debt in the world as % of GDP, where a breakaway of consumer price inflation could easily trigger a debt crisis. Moreover increasing monetization of her debt risks an inflation spiral.

Contrary to mainstream's expectations, once the inflation genie gets out of the bottle it will be hard to contain them, especially with politically influential power blocs resisting them. As in the case of Takashi, the military resisted spending cuts that led to Takashi's fatality.

Although we already seem to be seeing typical symptoms of geopolitical strains from inflationism through the Senkaku Island dispute.

About a week ago, both the Japanese and Chinese government reportedly scrambled jet fighters over the contested island nearly resulting to a direct confrontation (RT.com). Yesterday, 3 Chinese patrol ships reportedly entered Japanese territorial waters (Japan Daily Press).

The bottom line is that the effects of inflationism will ultimately be destabilizing for both the economy and in societal affairs, as depicted by the unfolding geopolitical developments.

No comments:

Post a Comment